Central banks are likely to kill prosperity, not inflation

23 June 2022

Market Insight by Belal Mohammed Khan

Reading time: 4.5 minutes

In the first half of 2022, formulating the investment view and asset allocation strategy became increasingly challenging as most central banks raced to undo the pandemic-related policy support and get inflation under control. As our previous publication stated:

“…investors are well-advised not to underestimate policymakers’ resolve to rein in inflation and inflation expectations … In creating long-lasting prosperity, policymakers will likely make decisions that will put both the economy and financial markets at risk. There are no easy, painless solutions.”

After completely getting the inflation forecast wrong, central banks are now apparently fully confident in getting it back down to target levels within predefined time frames. Forecasting inflation to move back towards 2% by 2024, as the case for the ECB, is likely a forecast just as off-the-mark as calling for 2% inflation when it is hovering comfortably over 5%. Getting inflation back down towards 2% by 2024 seems a daunting goal, and the statement “The Governing Council will make sure that inflation returns to its 2% target over the medium term” is beyond bold and ignores the reality of complex adaptive systems, as well as its forecasting track record.

We previously stated that:

“…economies and financial markets are complex adaptive systems (CAS) — forecasting them can be highly challenging. We have witnessed systemic forecasting errors over the past several decades. Institutions have repeatedly been either too optimistic or too pessimistic on key economic factors such as growth and inflation. Challenging forecasting environments and systemic forecasting errors across public and private institutions are “par for the course” for CAS and expected as we look forward to 2022 and beyond. Given these challenges, we have decided to stick with a reductionist approach to CAS challenges in building our investment thesis.”

The ECB and central banks, in general, aim to “maintain price stability” and preserve the currency’s purchasing power. For the ECB, this objective is set out in the Treaty on the Functioning of the European Union [1]. While the Treaty does not define price stability, the ECB’s Governing Council concluded after its July 2021 strategy review that price stability is best achieved by aiming for 2% inflation over the medium term.

Undoubtedly, price stability is an enormous challenge, underappreciated, and its complexity is misunderstood. In a world changing rapidly from multiple perspectives (geopolitical, demographic, and technological inspired socioeconomic transformation of societies [2]), policy frameworks in general and static frameworks are ill-equipped to deal with the world in a state of rapid change.

Inflation will likely remain elevated for an extended period, especially given the complex and problematic geopolitical environment. Beyond the issues and problems of supply chain disruptions and delays and disruption in the flow of critical commodities, global labor mobility has been disrupted as the world has become more fragmented. This contributes to the upward pressure on the cost of labor which is already under upward pressure due to ESG and UNDG targets. In addition, the continued maturation of key emerging markets, especially China, suggests price and inflation benefits since China’s entry into the World Trade Organization (WTO) are largely gone or fading fast. According to the National Bureau of Economic Research, U.S. imports of manufactured goods from China reduced the U.S. price index for manufactured goods by an estimated 7.6 percent between 2000 and 2006 due to China’s entry into the WTO. Such benefits are now clearly a thing of the past. Also worth noting is that the race towards a greener planet is resulting in the permeation of “greenflation”, a rise in the price of inputs needed in creating renewable technologies across the earth as countries race to meet climate goals.

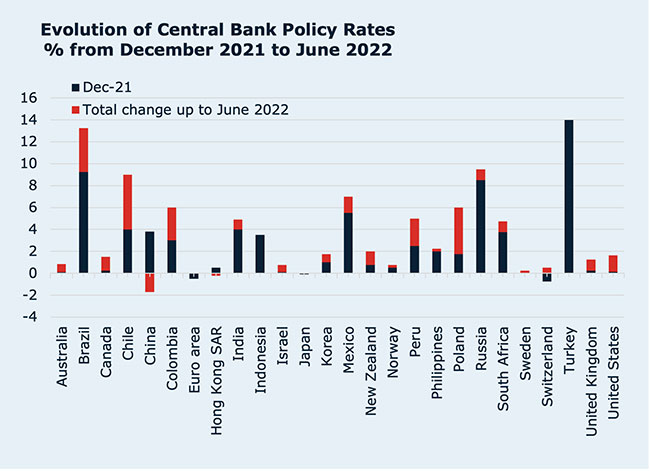

Thus, unlike most central banks, we expect higher inflation levels to persist for extended periods. Indeed, the combination of demand destruction from inflation and higher rates will not only push most significant economies into a recession but will result in a more extended period of contraction and a slower recovery. Central banks will not be able to come to the rescue of neither the economy nor the market. Keep in mind that the monetary policy tightening is global, being done across most regions and primarily still being done in a vacuum. It is a blunt tool for this complex problem.

To address inflation more effectively and efficiently, there needs to be full coordination and linkages between monetary, fiscal, trade, and foreign policy. The current silo policy framework needs to change. Unless there is a holistic approach to managing economies, growth will suffer in the quarters ahead. Central banks, in their effort to rein in inflation, will likely kill prosperity in the short term.

Once inflation eventually begins to recede, broad market opportunities will surface. In the meantime, a defensive asset allocation strategy will likely better weather market turbulence Portfolios need to be well diversified so that risk is spread out, and country, sector, and style selection will be critically important in helping to navigate markets in the months ahead.

Key quotes:

“Inflation is always and everywhere a monetary phenomenon, in the sense that it is and can be produced only by a more rapid increase in the quantity of money than in output.” — Milton Friedman (1956) Studies in the Quantity Theory of Money

“When you and I studied economics a million years ago, M2 and monetary aggregates seemed to have a relationship to economic growth.” “Right now … M2 … does not have important implications. It is something we have to unlearn, I guess.” — Fed Chair Powell, The Semi-Annual Monetary Policy Report to the Congress, 23 February 2021

Important notice

The information provided herein constitutes marketing material, that may contain general information, and has been prepared by personnel in the GMG Investment Solutions SA or GMG Institutional Asset Management SA (collectively “GMG”) and is not based on a consideration of the prospect’s circumstances. This document reflects the sole opinion of GMG or any entity of the GMG Group and it may contains generic recommendation.

Non-Reliance: This document does not constitute a recommendation or consider the particular investment objectives, financial conditions, or needs of individual clients. Before acting on this material, you should consider whether it is suitable for your circumstances and, if necessary, seek professional advice. GMG is not soliciting any specific action based on this material it is solely intended for illustration purpose.

This document is not the result of a financial analysis and therefore is not subject to the “Directive on the Independence of Financial Research” of the Swiss Bankers Association.

This document is neither a prospectus as per article 652a or 1156 of the Swiss Code of Obligations, a listing prospectus according to the listing rules of the SIX Swiss Exchange or any other exchange or regulated trading facility in Switzerland, nor a simplified prospectus, key investor information document or prospectus as defined in the Swiss Federal Collective Investment Schemes Act. Any benchmarks/indices cited in this document are provided for information purposes only.

The accuracy, completeness or relevance of the information which has been drawn from external sources is not guaranteed although it is drawn from sources reasonably believed to be reliable. Subject to any applicable law, GMG shall not assume any liability in this respect.

Risk Disclosure: This document is of summary nature. The products referred to herein involve numerous risks (including, without limitations, credit risk, market risk, liquidity risk and currency risk). In respect of securities trading, please refer for more information on such risks to the risk disclosure brochure “Risks Involved in Trading Financial Instruments – November 2019”, which is available for free on the following website of the Swiss Bankers’ Association: www.swissbanking.org/en/home.

Material May Be Outdated: This material is produced as of a particular date. Accordingly, this material may have already been updated, modified, amended and/or supplemented by the time you receive or access it. GMG is under no obligation to notify you of such changes and you should discuss this material with your GMG relationship manager to ensure such material has not been updated, modified amended and/or supplemented. The market information displayed in this document is based on data at a given moment and may change from time to time. In addition, the views reflected herein may change without notice. No updates to this document are planned. In the event that the reader is unsure as to whether the facts in this document are up to date at the time of their proposed investment, then they should seek independent advice or contact their relationship manager at GMG.

Information Not for Further Dissemination: This document is confidential and should not be reproduced, published, or redistributed without the prior written consent of GMG.