The euro currency’s future has become less certain

04 March 2022

Market Insight by Belal Mohammed Khan

Reading time: 2 minutes

The significance of the recent horrific developments in Eastern Europe is difficult to fathom but easier to do when taken in a historical context. In short, the events taking place are extraordinarily significant with far-reaching, long-lasting implications in almost all spheres of society, local, regional and global.

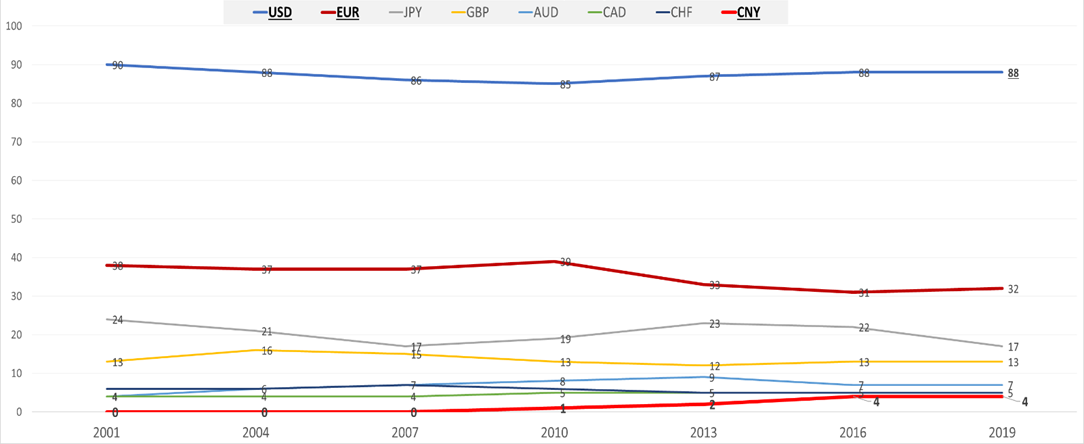

Regarding currencies, recent developments may very well suggest a need to reconsider the place of the Euro currency in the global currency hierarchy (see chart below). If the geopolitical risk calculus has changed worldwide due to recent events, it has especially and most significantly altered for the European continent.

As the second-highest traded volume currency, behind the USD, the EUR has played a significant role in global markets and global reserve portfolios. In the future, with the security structure of the European continent undergoing a seismic shift, the outlook for this second most crucial reserve currency has become less certain. Indeed, if our assertion that our world is undergoing a clearer bifurcation and that geopolitical divisions are becoming more entrenched as the world seems to be more clearly moving from unipolarity to bipolarity, the currency composition of global trade and central bank reserves may be under change as well. This is a long-term trend which we expect may play out in the quarters and years ahead.

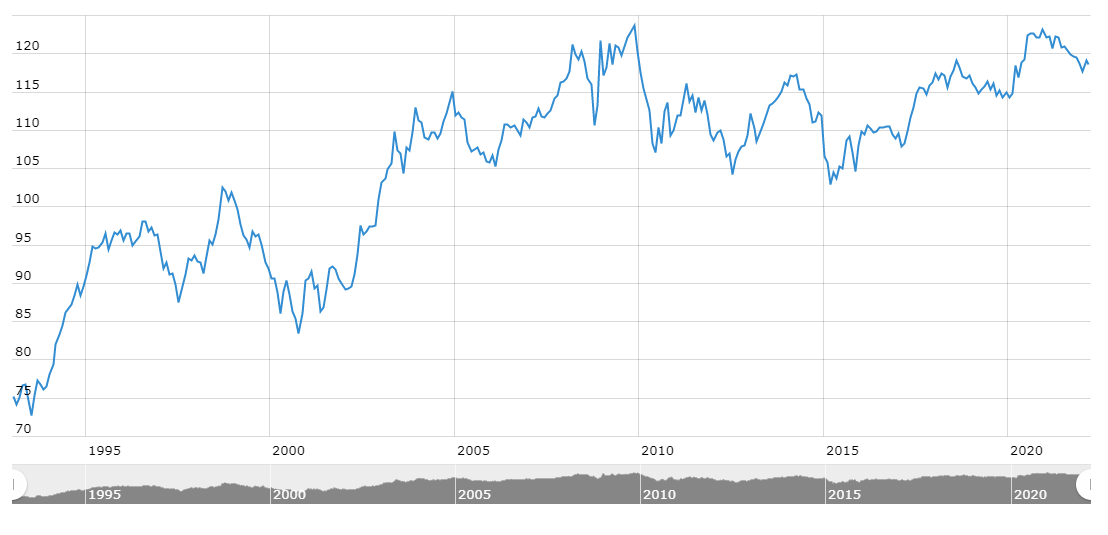

Thus, we believe investors with long Euro currency holdings, exposure, may need to rethink their currency allocation. Indeed, the Euro currency we believe is likely to come under sustained pressure versus other major development market currencies, especially such currencies that are firstly far geographically from the current geopolitical crisis and commodity price risk exposure and secondly, the currencies of countries with a higher and more favorable interest rate outlook. ECB data on the Euro nominal effective exchange rate (see second chart below) shows how this currency has behaved during recent history during the absence of any external severe security challenges to the euro area. With seismic shifts taking place, sustaining such historically elevated levels seems tremendously challenging.

We have looked at a variety of currencies and found that both at the currency pair level as well as with currency baskets, equally or GDP weighted, via cash or OTC option structures, there are several ways in which to reposition currency exposure and portfolios for a world in which the euro currency’s future has become less certain.

Global Currency Turnover

Top currencies by % of turnover of OTC FX – net basis

Euro Nominal Effective Exchange Rate

As of March 3, 2022

Important notice

The information provided herein constitutes marketing material, that may contain general information, and has been prepared by personnel in the GMG Investment Solutions SA or GMG Institutional Asset Management SA (collectively “GMG”) and is not based on a consideration of the prospect’s circumstances. This document reflects the sole opinion of GMG or any entity of the GMG Group and it may contains generic recommendation.

Non-Reliance: This document does not constitute a recommendation or consider the particular investment objectives, financial conditions, or needs of individual clients. Before acting on this material, you should consider whether it is suitable for your circumstances and, if necessary, seek professional advice. GMG is not soliciting any specific action based on this material it is solely intended for illustration purpose.

This document is not the result of a financial analysis and therefore is not subject to the “Directive on the Independence of Financial Research” of the Swiss Bankers Association.

This document is neither a prospectus as per article 652a or 1156 of the Swiss Code of Obligations, a listing prospectus according to the listing rules of the SIX Swiss Exchange or any other exchange or regulated trading facility in Switzerland, nor a simplified prospectus, key investor information document or prospectus as defined in the Swiss Federal Collective Investment Schemes Act. Any benchmarks/indices cited in this document are provided for information purposes only.

The accuracy, completeness or relevance of the information which has been drawn from external sources is not guaranteed although it is drawn from sources reasonably believed to be reliable. Subject to any applicable law, GMG shall not assume any liability in this respect.

Risk Disclosure: This document is of summary nature. The products referred to herein involve numerous risks (including, without limitations, credit risk, market risk, liquidity risk and currency risk). In respect of securities trading, please refer for more information on such risks to the risk disclosure brochure “Risks Involved in Trading Financial Instruments – November 2019”, which is available for free on the following website of the Swiss Bankers’ Association: www.swissbanking.org/en/home.

Material May Be Outdated: This material is produced as of a particular date. Accordingly, this material may have already been updated, modified, amended and/or supplemented by the time you receive or access it. GMG is under no obligation to notify you of such changes and you should discuss this material with your GMG relationship manager to ensure such material has not been updated, modified amended and/or supplemented. The market information displayed in this document is based on data at a given moment and may change from time to time. In addition, the views reflected herein may change without notice. No updates to this document are planned. In the event that the reader is unsure as to whether the facts in this document are up to date at the time of their proposed investment, then they should seek independent advice or contact their relationship manager at GMG.

Information Not for Further Dissemination: This document is confidential and should not be reproduced, published, or redistributed without the prior written consent of GMG.