The Fed put has expired — time to hedge

25 April 2022

Market Insight by Belal Mohammed Khan

Reading time: 4 minutes

The Fed put, the market’s expectation that the central bank will come to the aid of markets has been in place for decades. It’s the concept, belief, or reality that the central bank will initiate supportive monetary policy as a response to sharp market declines which are understood or perceived to be disconnected from fundamentals.

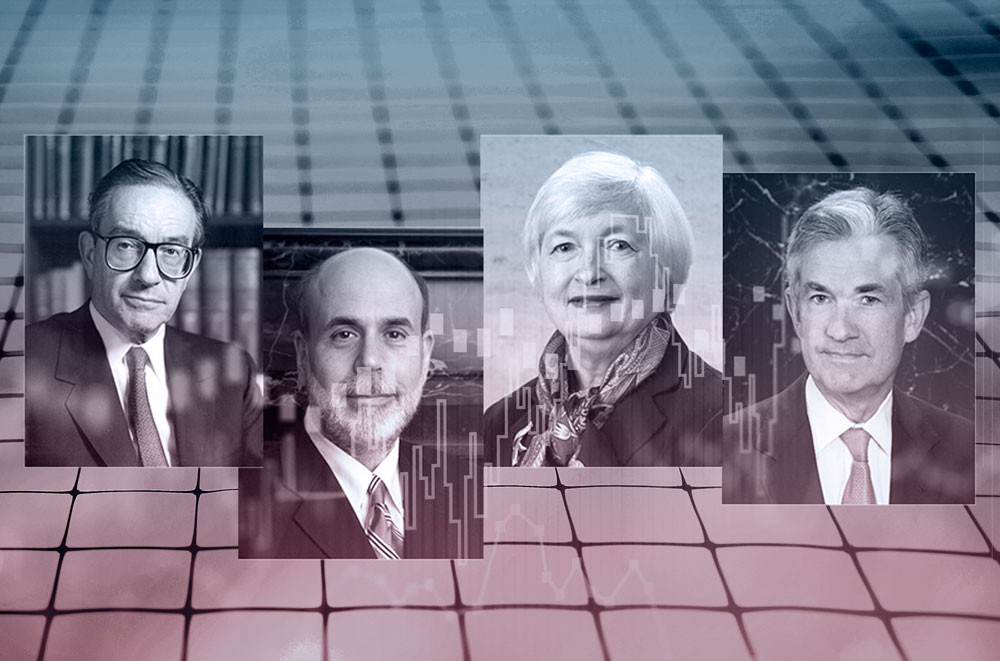

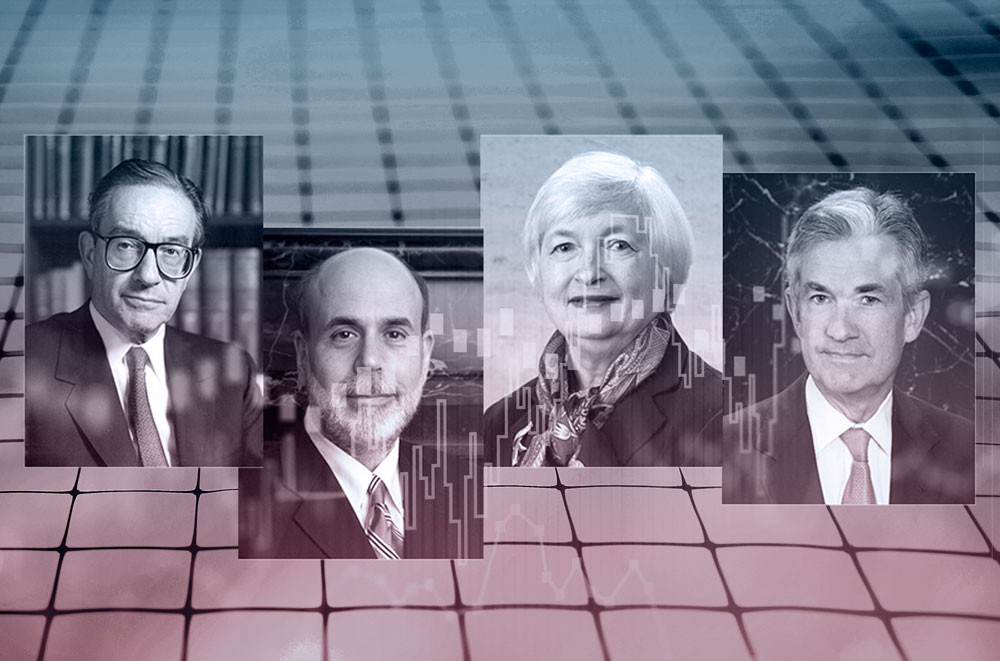

Decades ago, we used to refer to it as the Greenspan put, followed by the Bernanke put, and then more recently the Yellen put. Jerome Powell, the current Fed chair perhaps provided the most aggressive form of reassurance to markets with steady support since late 2019. However recently such possible market support coming from the monetary policy has become highly unlikely. Asset price deviations from fundamentals may not trigger monetary policy support as easily as what we have seen since 1987. Due to the sharply higher inflation data, the Fed put, we believe has expired.

In one of the most extraordinary changes of sentiment and policy path in US monetary policy history, the Federal Reserve Bank’s Federal Open Market Committee (FOMC), the monetary policy decision-making body, has moved from being ultra-dovish and accommodative to what now appears to be the opposite. Even some of the staunch doves at the Fed have turned into hawks. For investors, it’s worth noting that the combination of the FOMC’s about-face on inflation and policy, coupled with the changes brought about by the Fed’s framework review in 2020, are several reasons why believe the market now lacks a policy provided floor.

Regarding inflation as a variable, on March 1, 2022, US President Biden delivered his State of the Union address. He mentioned inflation six times and stated that getting inflation under control is his top priority (the FOMC statement for the March meeting also mentioned inflation six times).

“But with all the bright spots in our economy, record job growth, and higher wages, too many families are struggling to keep up with the bills. Inflation is robbing them of the gains they might otherwise feel. I get it. That’s why my top priority is getting prices under control.”

Since the State of the Union, one FOMC member after another has expressed heightened concern about inflation, which just as recent as Q4 2021 was described repeatedly by most FOMC members as “transitory.” Since March 1, the FOMC’s view change has been dramatic and extraordinary.

It is the blunder on inflation and now the inflation paranoia which is likely to prevent the Fed from coming to the rescue of markets if they begin to fall, even if the fall is sharp and large, we believe. Thus, downside risks have multiplied dramatically. However, March 1 may not have been the Fed’s expiration date.

The critical date in this whole debacle was likely August 27, 2020, when the US central bank abandoned the 2% inflation target and moved to the “average inflation target” of two percent. At the annual economic symposium at Jackson Hole, Wyoming, Chair Powell delivered his speech New Economic Challenges and the Fed’s Monetary Policy Review. The address, which we called a game-changer of massive proportions, is, in our view, the real put expiration date and trigger for the resurgence of inflation given the policy change we believe lifted the cap off inflation and inflation expectations. For those readers who are as keenly interested in this topic as we are, here below is one of the essential extracts from the August 2020 game-changing, put expiration speech:

“We have also made important changes with regard to the price-stability side of our mandate. Our longer-run goal continues to be an inflation rate of 2 percent. Our statement emphasizes that our actions to achieve both sides of our dual mandate will be most effective if longer-term inflation expectations remain well anchored at 2 percent. However, if inflation runs below 2 percent following economic downturns but never moves above 2 percent even when the economy is strong, then, over time, inflation will average less than 2 percent. Households and businesses will come to expect this result, meaning that inflation expectations would tend to move below our inflation goal and pull realized inflation down. To prevent this outcome and the adverse dynamics that could ensue, our new statement indicates that we will seek to achieve inflation that averages 2 percent over time. Therefore, following periods when inflation has been running below 2 percent, appropriate monetary policy will likely aim to achieve inflation moderately above 2 percent for some time.”

Looking forward, we expect inflation will likely run “hot” for some time; Any Fed tightening of policy, while it will impact markets, will only filter through to the real economy with a lag. Thus, this central bank will likely stay “behind the curve” longer than most expect. Fears about inflation expectations becoming unmoored may prompt fast and aggressive monetary policy adjustments. In the US political pressure to address inflation is likely to increase ahead of the November mid-term elections Indeed, it seems that this ‘independent’ central bank may come under intense pressure to “get prices under control.”

With these inflation and monetary policy complications coupled with the fading fiscal policy stimulus and heightened geopolitical uncertainty, growth Is expected to slow. Indeed, market downside risks have intensified. While we are not predicting a correction or bear market, we are however highlighting the absence of the market’s safety net; the central bank put. A negative market move therefore can become exaggerated, especially given the outsized role in the market of model and the high-frequency trading type of participants.

While we remain invested with allocations across the asset classes, our strategy has been pivoted towards beneficiaries of inflation and geopolitical divisions, which we expect will create steady outperformance of our portfolios. However, at the same time, a hedge overlay has become most appropriate given our belief that the central bank put has already expired.

Important notice

The information provided herein constitutes marketing material, that may contain general information, and has been prepared by personnel in the GMG Investment Solutions SA or GMG Institutional Asset Management SA (collectively “GMG”) and is not based on a consideration of the prospect’s circumstances. This document reflects the sole opinion of GMG or any entity of the GMG Group and it may contains generic recommendation.

Non-Reliance: This document does not constitute a recommendation or consider the particular investment objectives, financial conditions, or needs of individual clients. Before acting on this material, you should consider whether it is suitable for your circumstances and, if necessary, seek professional advice. GMG is not soliciting any specific action based on this material it is solely intended for illustration purpose.

This document is not the result of a financial analysis and therefore is not subject to the “Directive on the Independence of Financial Research” of the Swiss Bankers Association.

This document is neither a prospectus as per article 652a or 1156 of the Swiss Code of Obligations, a listing prospectus according to the listing rules of the SIX Swiss Exchange or any other exchange or regulated trading facility in Switzerland, nor a simplified prospectus, key investor information document or prospectus as defined in the Swiss Federal Collective Investment Schemes Act. Any benchmarks/indices cited in this document are provided for information purposes only.

The accuracy, completeness or relevance of the information which has been drawn from external sources is not guaranteed although it is drawn from sources reasonably believed to be reliable. Subject to any applicable law, GMG shall not assume any liability in this respect.

Risk Disclosure: This document is of summary nature. The products referred to herein involve numerous risks (including, without limitations, credit risk, market risk, liquidity risk and currency risk). In respect of securities trading, please refer for more information on such risks to the risk disclosure brochure “Risks Involved in Trading Financial Instruments – November 2019”, which is available for free on the following website of the Swiss Bankers’ Association: www.swissbanking.org/en/home.

Material May Be Outdated: This material is produced as of a particular date. Accordingly, this material may have already been updated, modified, amended and/or supplemented by the time you receive or access it. GMG is under no obligation to notify you of such changes and you should discuss this material with your GMG relationship manager to ensure such material has not been updated, modified amended and/or supplemented. The market information displayed in this document is based on data at a given moment and may change from time to time. In addition, the views reflected herein may change without notice. No updates to this document are planned. In the event that the reader is unsure as to whether the facts in this document are up to date at the time of their proposed investment, then they should seek independent advice or contact their relationship manager at GMG.

Information Not for Further Dissemination: This document is confidential and should not be reproduced, published, or redistributed without the prior written consent of GMG.