NEWSLETTER: AOÛT 2021

Uneven Economies, Uneven Markets

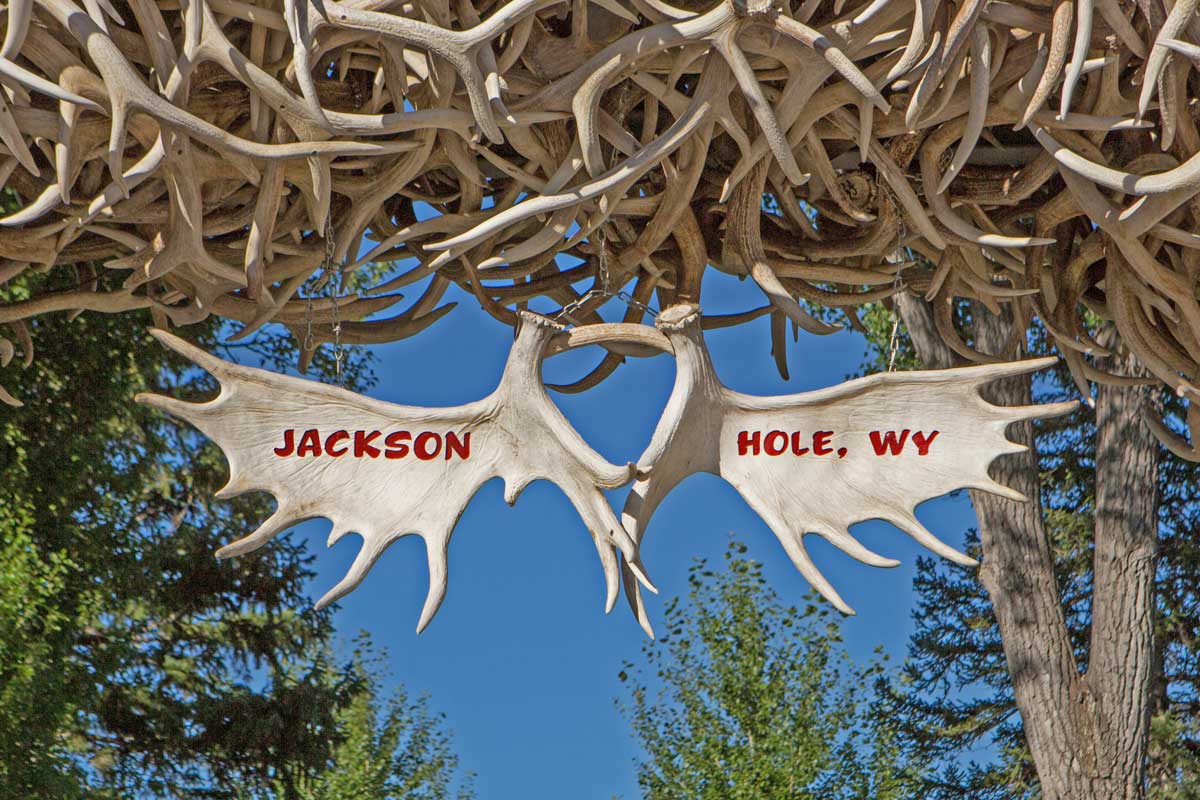

Investor perception of market risk is likely to rise. This will be predominately driven by headline risk concerns emanating from the Federal Reserve Bank of Kansas City’s annual Economic Policy Symposium at Jackson Hole, Wyoming, August 26-28.

This year’s event is likely to reveal concern in policy-making circles about, (1) the Global economic reality of uneven growth, and (2) thus policy responses that will be uneven, different, and at different speeds. In such an environment markets will likely experience a greater degree of performance dispersion. Correlations we have seen over the past several years may begin to break down.

With regards to the Annual Economic Policy Symposium, unlike last year when the US Fed introduced Average Inflation Targeting (AIT), this year, to a very large extent, we expect the dozens of speakers and papers to reiterate the same message central bankers have been communicating over the past two quarters that policy support is still required as economies still trying to shake of the shackles of the pandemic. The main focus is however likely to fall on inflation and inflation expectations. Central bankers are likely to communicate that not only are higher inflation levels desirable but that higher inflation levels will be tolerated and for an undefined period of time, before policy begins to respond.

We will be closely monitoring any change in the language and communication on risks to the inflation outlook. We expect more officials and economists will begin to express inflation risk concerns, and this may lead to some turbulence in markets and more concerns about stagflation.

We would view market turbulence surfacing as an opportunity given there is still strong positive growth, policy, whether monetary or fiscal remains very supportive in most major economies. In addition to all of these supportive factors, real rates are still comfortably in negative territory, thus indeed, risk-on assets will remain in strong demand, we believe. While we would view any market turbulence as an opportunity to add risk, a greater degree of diligence is required. Economies are moving at different speeds, and we expect more policymakers to begin shifting their inflation views and expectations. Our view has been that much of the inflation pick-up is not transitory, therefore portfolios need to be finely tuned to not only withstand headwinds from higher and sticky inflation expectations but also to benefit from such an inflation outlook.

Asset allocation: our balanced portfolio remains risk-on with an underweight in sovereign bonds, overweight in high yield. We look to build an overweight in TIPs. In Equities we remain overweight with a preference for US, EU and Swiss small cap. Our China allocation remains at an underweight. We hold a small overweight in gold as we expect growing concern about inflation and inflation expectations.