Broadening State Support, Supportive of Risk Assets

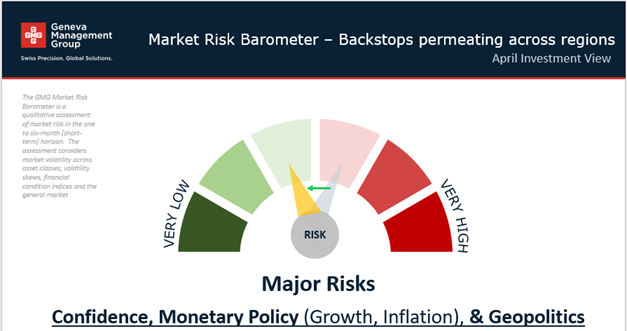

– Improved Market Outlook due to safety nets and more measured monetary policy tightening.

– Geopolitical narrative expected to shift towards peace and reconciliation ahead of elections US and EU.

– Developed market economies, US, EU, UK, and Japan, may experience a growth deceleration as tighter monetary policy in place now for several quarters begins to impact.

– We are tilting portfolios from defensive towards mild risk-on. Public market positioning:

- Cash – Reduce overweight.

- Fixed Income – No change; remain underweight. Within Fixed Income we remain overweight select emerging market debt.

- Equities – Move to overweight. Within Equities we move developed market equity to overweight, adjust our sector and style allocation and remain overweight select emerging markets.

- Hedge Funds – No change; remain underweight.

- Gold – Reduce overweight.

- Commodities – No change; remain overweight.

- Volatility – Reduce overweight.

The market outlook has improved due to rapid action across regions to address banking and financial market stability concerns. Government officials understand the need to ensure that the financial system remains sound and fully operational. As such, we expect, central banks will adjust policy in a more measured manner. In addition, Chinese President Xi and his party have tried to introduce the idea of peace and dialogue into the narrative regarding the war in Ukraine. Ahead of elections in the US and EU Parliament, China’s initiative, although lacking details, may nevertheless help move voters and some politicians to favor dialogue and peace over war and further destruction.

“After all, there is an element in the readjustment of our financial system more important than currency, more important than gold, and that is the people’s confidence.” President Franklin D. Roosevelt March 12, 1933

The task of managing the economy is tremendously complex, but the authorities know what is at risk. Confidence in the system needs to be fortified ASAP. The Fed, FDIC, FASB (GAAP), and Treasury, all need to work together to find ways to reduce risk urgently. Banks serve a critical purpose and thus should be allowed to take on only limited risks. A sector that is critically important for the national economic security of a country needs to be more heavily regulated. As for the Fed and other policy arms, the silo approach to managing economies needs to make way for an intensely collaborative approach to effectively managing a complex economy in our complex world.

For now, we expect the official response to the banking mini crisis in the US and Europe to be adequate and prevent further erosion of confidence. If needed, authorities will respond more aggressively, comprehensively to stem any further deterioration of confidence due to concerns about the banking sector. Investor confidence, however, is fickle and can change quickly. Thus, we will remain vigilant for any signs of stress while stepping back into an overweight equity allocation.

Recent geopolitical developments again provide evidence of continued geopolitical fragmentation. China and US continue to create two distinct camps. Meanwhile, some nations are left to “thread the needle” and try to balance relations with these two superpowers. On the other hand, several constructive developments suggest a possible improvement of the geopolitical narrative. Events include reestablishing diplomatic ties between Saudi Arabia and Iran and furthering relations between Russia and China after China put forward a peace plan for the war in Ukraine. Meanwhile, NATO continues to favor war over dialogue and has not taken the Chinese president’s political settlement of the Ukraine crisis plan seriously put forward on February 24.

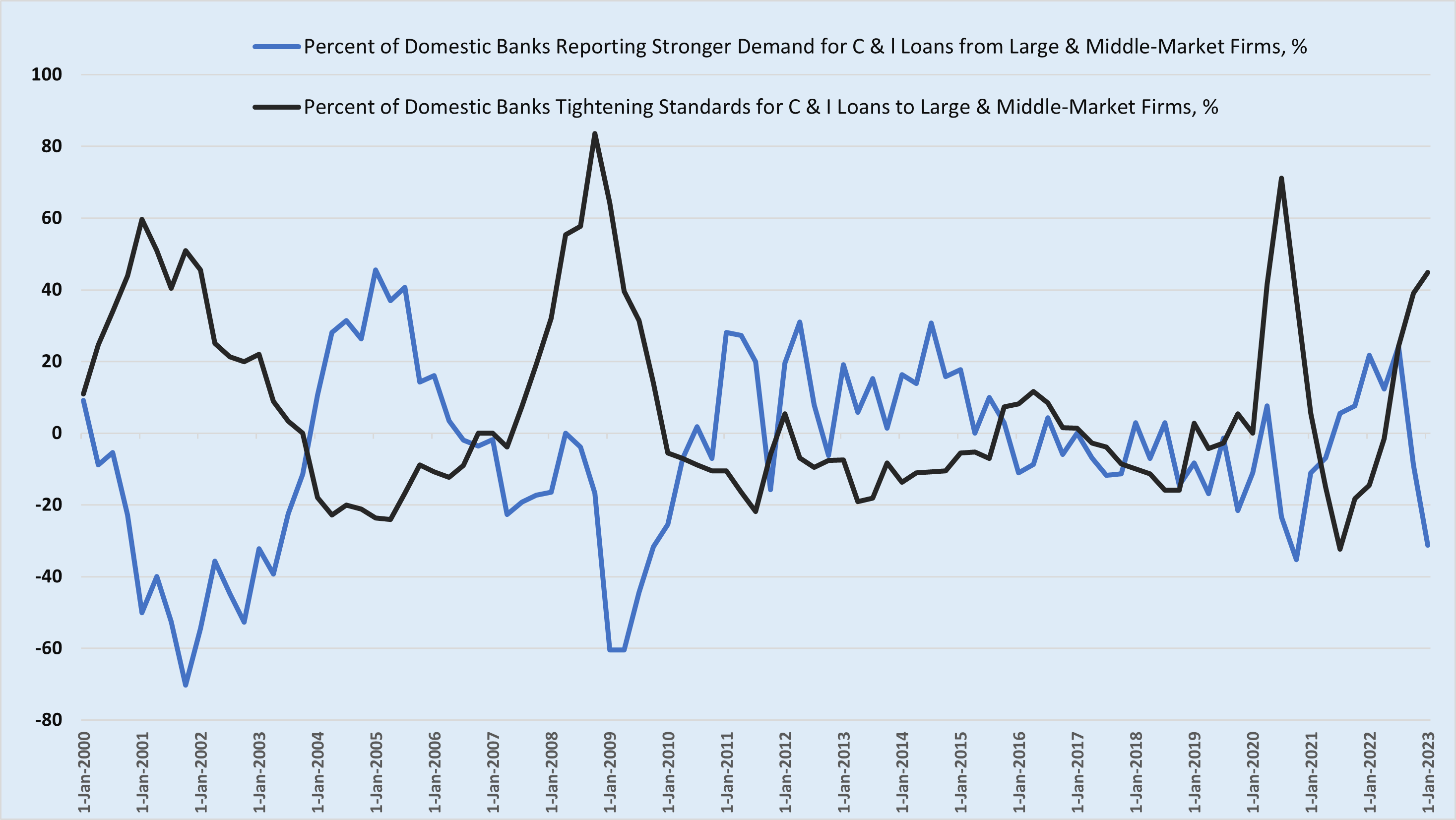

The global economic outlook has been somewhat resilient. PMI data show signs of some recovery across economies, but markets are more concerned about financial market stability. Given the recent market turbulence, data is taking a back seat to stability concerns. We believe authorities will do what is necessary to maintain stability; thus, concerns are overdone. However, lingering worries about financial market stability will further slow or delay monetary policy tightening. Other economic activity data are mixed, showing signs of weakness in business and consumer spending. Furthermore, bank lending standards in both US and EU have tightened while demand for loans and credit has dropped, see chart below for US.

Still, at the same time, additional data offer signs of either stabilization or pickup in economic activity. Composite PMI data for many economies are showing signs of some stabilization. For significant economies US, EU, and China, government-led programs and initiatives are helping to create activity across economies. In the US, combining the Inflation Reduction Act of 2022, The CHIPS Act of 2021, and the Infrastructure Bill of 2021 collectively make ongoing activity across the industry. In the EU, the Next Generation, Horizon Europe, Invest EU, European Green Deal, and Digital Europe Programme, are examples of EU programs to stimulate growth and make the EU more competitive and greener. In addition, the government has a long list of programs and plans to reinvigorate growth in key strategic sectors in China. In the GCC, the energy price windfall from the past few years (April 2020 trough to August 2022 peak, +60%) has accelerated diversification plans and programs.

While there are some downside risks stemming from financial market stability concerns, we expect authorities to act aggressively and protect the financial Infrastructure. Thus, we believe such risks to be limited in severity and duration. Meanwhile, inflation remains a problem. Therefore, central banks must continue with their effort to contain and bring inflation to a lower level remains in place. However, unless there is heavy margin compression, a slowing economy is not necessarily harmful to markets, given it suggests major central banks may be near the end of this tightening cycle. Given our view that central banks will focus more on financial market stability than inflation, further rate hikes will be slow and small, supportive of both financial market stability and select risk-on assets.

Important notice

The information provided herein constitutes marketing material, that may contain general information, and has been prepared by personnel in GMG Asset Management SA (collectively “GMG”) and is not based on a consideration of the prospect’s circumstances. This document reflects the sole opinion of GMG or any entity of the GMG Group and it may contains generic recommendation.

Non-Reliance: This document does not constitute a recommendation or consider the particular investment objectives, financial conditions, or needs of individual clients. Before acting on this material, you should consider whether it is suitable for your circumstances and, if necessary, seek professional advice. GMG is not soliciting any specific action based on this material it is solely intended for illustration purpose.

This document is not the result of a financial analysis and therefore is not subject to the “Directive on the Independence of Financial Research” of the Swiss Bankers Association.

This document is neither a prospectus as per article 652a or 1156 of the Swiss Code of Obligations, a listing prospectus according to the listing rules of the SIX Swiss Exchange or any other exchange or regulated trading facility in Switzerland, nor a simplified prospectus, key investor information document or prospectus as defined in the Swiss Federal Collective Investment Schemes Act. Any benchmarks/indices cited in this document are provided for information purposes only.

The accuracy, completeness or relevance of the information which has been drawn from external sources is not guaranteed although it is drawn from sources reasonably believed to be reliable. Subject to any applicable law, GMG shall not assume any liability in this respect.

Risk Disclosure: This document is of summary nature. The products referred to herein involve numerous risks (including, without limitations, credit risk, market risk, liquidity risk and currency risk). In respect of securities trading, please refer for more information on such risks to the risk disclosure brochure “Risks Involved in Trading Financial Instruments – November 2019”, which is available for free on the following website of the Swiss Bankers’ Association: www.swissbanking.org/en/home.

Material May Be Outdated: This material is produced as of a particular date. Accordingly, this material may have already been updated, modified, amended and/or supplemented by the time you receive or access it. GMG is under no obligation to notify you of such changes and you should discuss this material with your GMG relationship manager to ensure such material has not been updated, modified amended and/or supplemented. The market information displayed in this document is based on data at a given moment and may change from time to time. In addition, the views reflected herein may change without notice. No updates to this document are planned. In the event that the reader is unsure as to whether the facts in this document are up to date at the time of their proposed investment, then they should seek independent advice or contact their relationship manager at GMG.

Information Not for Further Dissemination: This document is confidential and should not be reproduced, published, or redistributed without the prior written consent of GMG.