SVB, the bark will be worse than the bite

We expect only a limited contagion from the Silicon Valley Bank fiasco.

Silicon Valley Bank, (SVB) was a unique bank, unlike most other banks, especially the global systemically important banks (G-SIBs). The Fed will hold a closed meeting of the Board of Governors of the Federal Reserve System, Monday with an aim to contain the damage and find solutions and stabilize the situation.

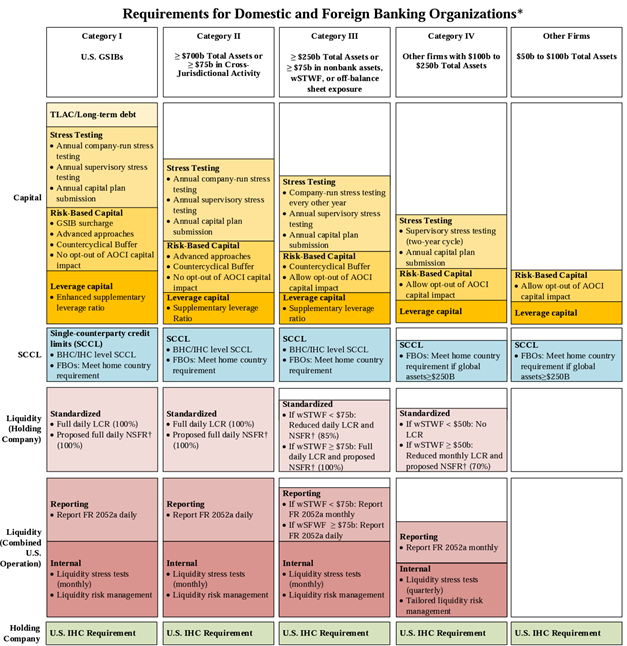

SVB was a “category IV” institution (see image at bottom), which mismanaged its balance sheet and interest rate exposure during this aggressive monetary policy tig Couple this backdrop with digital banking, on a computer or handheld device and social media, and information and money can move in large quantities and with great speed. At the first few signs of trouble, SVB depositors and investors withdrew USD42 billion in one day! Not a good development for a bank in need of liquidity.

While we expect only a limited contagion from the SVB fiasco, markets may nevertheless fall further on other factors including profit-taking, model, and momentum trading. This SVB event may force markets to reprice US monetary policy expectations as market participants conclude the Fed will have to hold back the next rate hike or at least reduce the size from 50bp to a 25bp hike.

Regarding the institution, it was SVB Financial Group (SVBFG), a diversified financial services company, as well as a bank holding company and financial holding company. The principal subsidiary of SVG-FG was SVB, a California state-chartered bank founded in 1983. SVBFG had four operating segments, the Global Commercial Bank (GCB), SVP Private Bank, SVB Capital and SVB Securities.

The bank, SVB almost exclusively served clients primarily in the technology and life science/healthcare industries. SVB also had a business line focused on the wine industry with, SVB Wine which provided banking products and services to our “premium wine industry clients”.

As mentioned, SVB was a category IV institution, thus not subject to strong capital, liquidity or reporting requirements such as required for I, II or III category financial institutions. If Basel III* rules were evenly applied across the US banking system SVB’s profile would have been different, and more sound.

While most other countries applied Basel III evenly across banking systems, the US did not. The US Federal Deposit Insurance Corporation (FDIC) and the Federal Reserve Bank took another course of action and categorized banks with rules being applied according to various size considerations.

Key among the requirements, the ones which would have helped flag the problem or help address it early would have been liquidity and reporting requirements. For example, SVBFG 10-K 2021 report states:

- Resolution Planning. Category III firms, but not Category IV firms, are required to submit to the Federal Reserve and the FDIC a plan for rapid and orderly resolution in the event of material financial distress or failure.

- Liquidity Requirements. Category IV institutions with greater than $50 billion in WSTWF, as well as Category I-III organizations, are subject to LCR and net stable funding ratio (“NSFR”) requirements and must maintain high-quality liquid assets in accordance with specific quantitative requirements. However, the above-mentioned Category IV institutions, as well as Category III institutions with less than $75 billion in WSTWF, are subject to reduced LCR and NSFR requirements. Category III institutions with greater than $75 billion in WSTWF and all Category I-II organizations are subject to the full LCR and NSFR requirements. As of December 31, 2021, we have less than $50 billion in WSTWF, therefore, we are currently not subject to LCR and NSFR requirements.

- Single counterparty credit limit. In June 2018, the Federal Reserve issued a final rule regarding single-counterparty credit limits (“SCCL”) for large banking organizations, excluding Category IV firms, subjecting them to a limit of 25% of Tier 1 capital for aggregate net credit exposures to any other unaffiliated counterparty. Given SVB Financial is a Category IV firm, we are not subject to the SCCL requirements.

Along with SVB, many other Category IV financial firms may come under pressure, but as stated earlier, SVB was a different type of bank, very different. The fallout will be limited, and well contained by authorities.

However, it does bring to light many issues including deposit insurance, categorization of banks, adverse effects of mismanaged and aggressive monetary policy reaction function and finally, the need to better understand capital flow/flight risks in our digital age.

Portfolio Implications: Know whats in your portfolio. In current times and for the foreseeable future, our investment strategy has a strong quality bias. Quality companies and niche strategies can best maneuver complex times. The market focus needs to redirect itself again to the inflation fight and the need for central banks in major economies, except for China, to remain diligent and vigilant and try to get inflation under some control. So our investment strategy remains unchanged. SVB created widespread fear, but there will be limited fallout.

* Certain requirements for a foreign bank are determined by the risk profile of its intermediate holding company, whereas other requirements are determined by the risk profile of the firm’s combined U.S. operations. Capital and standardized liquidity standards are determined by the risk profile of the intermediate holding company and other standards are determined by the risk profile of the firm’s combined U.S. operations. Other foreign banks with limited U.S. presence and global assets of $100 billion

or more would be subject to certain minimum standards.† The proposed net stable funding ratio (NSFR) rule will not be finalized as a result of the tailoring final rule. Glossary: wSTWF – weighted short-term wholesale funding; HCs –bank, savings and loan, or intermediate holding company; CUSO – combined U.S. operations; AOCI – accumulated other comprehensive income; CCAR – Comprehensive Capital

Analysis and Review; LCR – liquidity coverage ratio.

[1] Basel III is an internationally agreed set of measures developed by the Basel Committee on Banking Supervision in response to the financial crisis of 2007-09. The measures aim to strengthen the regulation, supervision and risk management of banks. Like all Basel Committee standards, Basel III standards are minimum requirements which apply to internationally active banks. Members are committed to implementing and applying standards in their jurisdictions within the time frame established by the Committee.

[3] CFR-2022-title12-vol4sec252-5 Categorization of banking organizations

Important notice

The information provided herein constitutes marketing material, that may contain general information, and has been prepared by personnel in GMG Asset Management SA (collectively “GMG”) and is not based on a consideration of the prospect’s circumstances. This document reflects the sole opinion of GMG or any entity of the GMG Group and it may contains generic recommendation.

Non-Reliance: This document does not constitute a recommendation or consider the particular investment objectives, financial conditions, or needs of individual clients. Before acting on this material, you should consider whether it is suitable for your circumstances and, if necessary, seek professional advice. GMG is not soliciting any specific action based on this material it is solely intended for illustration purpose.

This document is not the result of a financial analysis and therefore is not subject to the “Directive on the Independence of Financial Research” of the Swiss Bankers Association.

This document is neither a prospectus as per article 652a or 1156 of the Swiss Code of Obligations, a listing prospectus according to the listing rules of the SIX Swiss Exchange or any other exchange or regulated trading facility in Switzerland, nor a simplified prospectus, key investor information document or prospectus as defined in the Swiss Federal Collective Investment Schemes Act. Any benchmarks/indices cited in this document are provided for information purposes only.

The accuracy, completeness or relevance of the information which has been drawn from external sources is not guaranteed although it is drawn from sources reasonably believed to be reliable. Subject to any applicable law, GMG shall not assume any liability in this respect.

Risk Disclosure: This document is of summary nature. The products referred to herein involve numerous risks (including, without limitations, credit risk, market risk, liquidity risk and currency risk). In respect of securities trading, please refer for more information on such risks to the risk disclosure brochure “Risks Involved in Trading Financial Instruments – November 2019”, which is available for free on the following website of the Swiss Bankers’ Association: www.swissbanking.org/en/home.

Material May Be Outdated: This material is produced as of a particular date. Accordingly, this material may have already been updated, modified, amended and/or supplemented by the time you receive or access it. GMG is under no obligation to notify you of such changes and you should discuss this material with your GMG relationship manager to ensure such material has not been updated, modified amended and/or supplemented. The market information displayed in this document is based on data at a given moment and may change from time to time. In addition, the views reflected herein may change without notice. No updates to this document are planned. In the event that the reader is unsure as to whether the facts in this document are up to date at the time of their proposed investment, then they should seek independent advice or contact their relationship manager at GMG.

Information Not for Further Dissemination: This document is confidential and should not be reproduced, published, or redistributed without the prior written consent of GMG.