Time for pause; lags and stability concerns

Summary:

- After the next rate hikes, most major central banks should pause further tightening monetary policy.

- Due to multiple lags, monetary policy has not slowed the economy as quickly as central banks desired.

- The absence of fiscal and monetary policy coordination has compounded the challenges of combating inflation.

- Central banks must acknowledge the higher inflation era and adjust their time horizon to reach price stability (inflation targets).

- Given the necessity of allowing lags to fully play out, fade and apprehensions regarding financial stability, the current juncture calls for a policy pause.

Portfolio implications – We expect a monetary policy pause, continued fiscal policy tailwinds, slowing geopolitical fragmentation, and a move towards pragmatic multilateralism to be constructive for select risk assets.

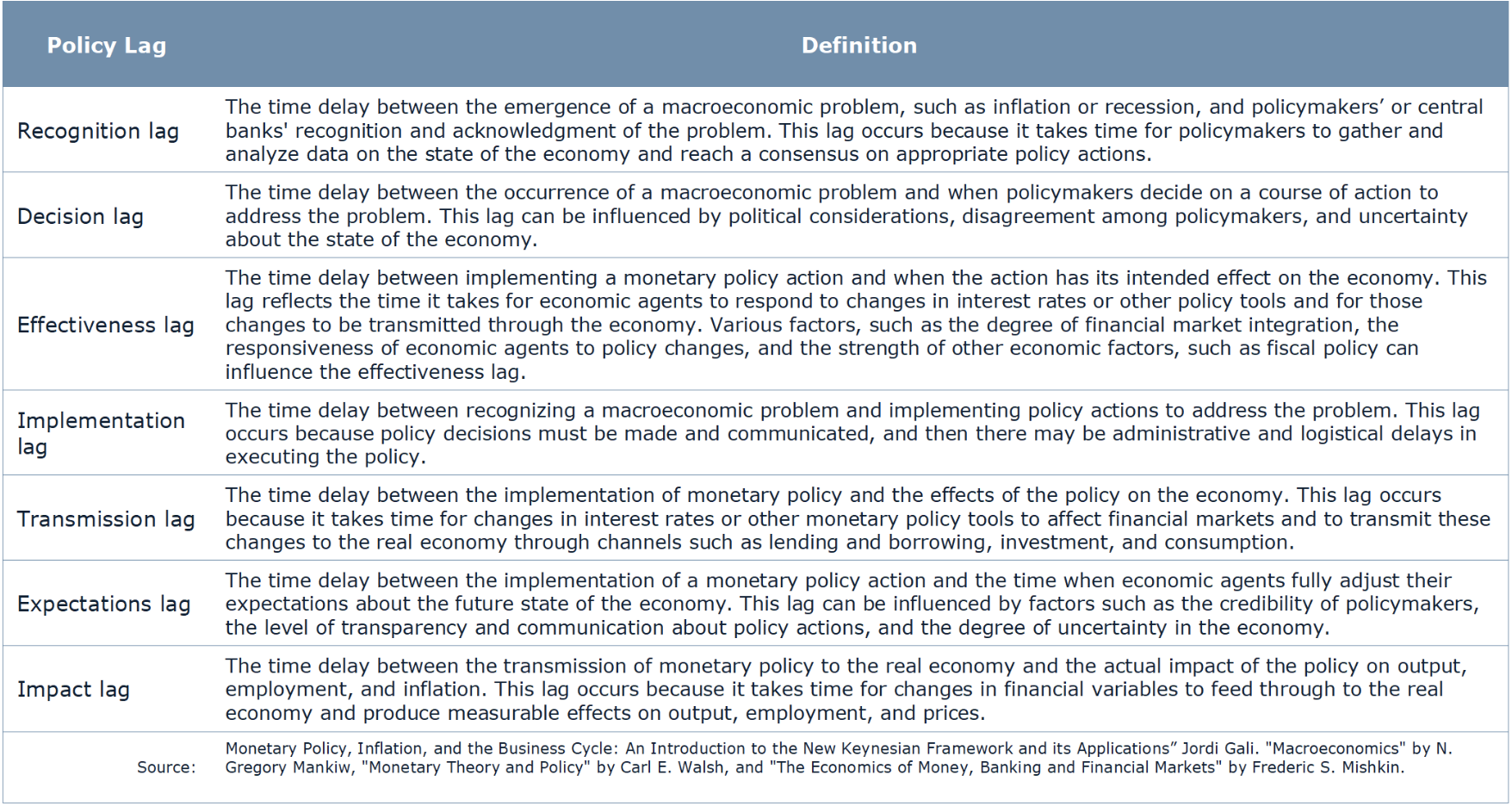

No doubt monetary policy works with a lag; we know this. However, no one knows what that lag may look like, feel like, and more importantly: how long lags may last. While many focus on the impact lag of monetary policy, multiple other lags are also in play, especially during this bout of tightening monetary policy tightening.

During this bout of monetary policy tightening, we believe almost all lags have contributed to the inability of authorities to rein in inflation to the extent they desire. The problem of tackling inflation started with recognition lag and moved on to decision lag; Most major central banks were late, way behind in detecting the macroeconomic situation of rising price pressures and prices. However, the problem does not end there; beyond the recognition and decision lag, every other possible lag has played its parts, such as the effectiveness, transmission, expectations, and impact lag. The only thing major central banks were generally efficient about was implementation, and thus, during this bout of inflation and monetary policy adjustments, the implementation lag was short.

Regarding the current macroeconomic inflation problem, most central banks were slow or slow to understand and acknowledge it. The period between the emergence of a macroeconomic issue and its acknowledgment by the authorities, commonly known as the recognition lag, was strikingly prolonged. This is particularly noteworthy from our vantage point. We had already been convinced that inflation was a present reality and would persist, as expressed in our August 2021, GMG Investment Briefing, titled Reflation Convictions 1. While we got the inflation call right, we were too ambitious on the transmission and impact lag.

The perils associated with such lags are not to be underestimated, for they can potentially prompt the untimely implementation of policy measures or prolong the application of policy actions – be it easing, tightening, or maintaining a steady course.

At present, the attention is on understanding the impact lag, the delay between policy measures taken, and the time of impact on the economy. On the impact lag, our expectations were for a faster effect. As such, we positioned our portfolios defensively since November 2022. The impact on economies is finally beginning to surface, as evidenced by recent forward-looking economic data. However, with some signs of deceleration in economic activity, economies have a surprising robustness. This is primarily due to targeted fiscal programs focused on greater self-reliance of economies. Additionally, the impact lag is also a function of the transmission lag.

Since the current monetary policy tightening cycle, central banks have aggressively tightened monetary policy. However, the impact has been slower than anticipated, perhaps due to the reference above to fiscal programs. Still, it may also be due to the more sophisticated banking and financing infrastructure since the Great Financial Crisis. In their paper Transmission Lags of Monetary Policy: A Meta-Analysis, Haveranet & Runak, 2013 2, the authors conclude that the average transmission lag time is twenty-nine months. Furthermore, such lags are longer in developed economies with more advanced financial sectors, “The key result of our meta-analysis is that a higher degree of financial development translates into a slower transmission of monetary policy.” This is because financial institutions in such economies can access more sophisticated solutions to deal with monetary policy adjustments.

Due to the transmission lags in economies where financial institutions have access to more tools, the impact lag tends to be longer; the US is one example. The first rate hike in the current monetary policy tightening cycle was on March 16, when the US central bank increased its main policy rate by 25bp. As such, we are now in the thirteenth month. Taking the meta-analysis results mentioned earlier, we still have sixteen months before the broader impact begins to surface more clearly.

However, the effectiveness of policy actions is also a function of other factors, including fiscal policy. Hence, as the central bank has worked to decelerate economic growth and tame inflation, fiscal policies (exemplified by new initiatives such as the Inflation Reduction Act of 2022, The CHIPS Act of 2021, and the Infrastructure Bill of 2021) have acted as a counterforce to monetary policy measures and a catalyst for further economic expansion.

Indeed, the Euro area has similarly witnessed the implementation of various fiscal initiatives, such as the Next Generation, Horizon Europe, Invest EU, European Green Deal, and Digital Europe Programme, which have been instrumental in mitigating the effects of monetary policy contraction to a certain extent.

The lack of fiscal and monetary policy coordination in tackling the inflation problem has made the inflation fight more challenging and complex for central banks. It is time they acknowledge the complexity of the task and adjust their time horizon for reaching their price stability targets.

While central bank independence is critical to managing monetary policy, exceptions must be allowed for fiscal and monetary policy coordination, not just for stimulating the economy but also for slowing it down. Moreover, complex adaptive systems such as economies, especially in our modern era, require multiple tools for effective management, not just one.

We believe the need to let lags play out and continued concerns about financial market stability will allow central banks to pause monetary policy tightening. This is constructive for select risk-on assets, and any further signs of growth deceleration will further support the policy pause.

While geopolitical fragmentation has contributed to inflation pressures, see Geopolitical shifts towards multipolarity, GMG Insights, September 2021 3, recent developments suggest that the world may be approaching peak fragmentation, with a growing emphasis on pragmatic multilateralism4. As a result, the tensions stemming from geopolitical fragmentation are unlikely to escalate further. The urgent need for pragmatic multilateralism was the message, surprisingly delivered by the US Secretary of the Treasury, Janet Yellen5, in her April 20 speech on the US-China relationship. In her address, she calls for a healthy economic engagement with China.

The broader message of the need for cooperation between US-China is strikingly like what Chinese President Xi and other senior Chinese officials have, for years, been trying to promote6.

If leadership on both sides now calls for greater cooperation and a move towards more pragmatic multilateralism, this will indeed be a welcomed and positive development for the global economy.

Source:

- https://gmgfinancial.com/reflation-convictions/

- https://gmgfinancial.com/geopolitical-shifts/

- https://www.ijcb.org/journal/ijcb13q4a2.htm

- https://www.banque-france.fr/en/intervention/how-central-banks-should-face-instability-and-fragmentation5.

- https://home.treasury.gov/news/press-releases/jy1425

- https://www.fmprc.gov.cn/mfa_eng/wjdt_665385/zyjh_665391/202303/t20230302_11034157.html

- https://www.fmprc.gov.cn/mfa_eng/zxxx_662805/202207/t20220710_10718093.html

- https://intermestic.unpad.ac.id/index.php/intermestic/article/view/385

Important notice

The information provided herein constitutes marketing material, that may contain general information, and has been prepared by personnel in GMG Asset Management SA (collectively “GMG”) and is not based on a consideration of the prospect’s circumstances. This document reflects the sole opinion of GMG or any entity of the GMG Group and it may contains generic recommendation.

Non-Reliance: This document does not constitute a recommendation or consider the particular investment objectives, financial conditions, or needs of individual clients. Before acting on this material, you should consider whether it is suitable for your circumstances and, if necessary, seek professional advice. GMG is not soliciting any specific action based on this material it is solely intended for illustration purpose.

This document is not the result of a financial analysis and therefore is not subject to the “Directive on the Independence of Financial Research” of the Swiss Bankers Association.

This document is neither a prospectus as per article 652a or 1156 of the Swiss Code of Obligations, a listing prospectus according to the listing rules of the SIX Swiss Exchange or any other exchange or regulated trading facility in Switzerland, nor a simplified prospectus, key investor information document or prospectus as defined in the Swiss Federal Collective Investment Schemes Act. Any benchmarks/indices cited in this document are provided for information purposes only.

The accuracy, completeness or relevance of the information which has been drawn from external sources is not guaranteed although it is drawn from sources reasonably believed to be reliable. Subject to any applicable law, GMG shall not assume any liability in this respect.

Risk Disclosure: This document is of summary nature. The products referred to herein involve numerous risks (including, without limitations, credit risk, market risk, liquidity risk and currency risk). In respect of securities trading, please refer for more information on such risks to the risk disclosure brochure “Risks Involved in Trading Financial Instruments – November 2019”, which is available for free on the following website of the Swiss Bankers’ Association: www.swissbanking.org/en/home.

Material May Be Outdated: This material is produced as of a particular date. Accordingly, this material may have already been updated, modified, amended and/or supplemented by the time you receive or access it. GMG is under no obligation to notify you of such changes and you should discuss this material with your GMG relationship manager to ensure such material has not been updated, modified amended and/or supplemented. The market information displayed in this document is based on data at a given moment and may change from time to time. In addition, the views reflected herein may change without notice. No updates to this document are planned. In the event that the reader is unsure as to whether the facts in this document are up to date at the time of their proposed investment, then they should seek independent advice or contact their relationship manager at GMG.

Information Not for Further Dissemination: This document is confidential and should not be reproduced, published, or redistributed without the prior written consent of GMG.