Markets in Stalemate – Seek Yield, Income and Carry

While there is growing optimism, or shrinking pessimism, on many fronts, including China, China-US relations, the resiliency of the US economy, and the general geopolitical climate, which may experience a thaw, such views may be misplaced. Instead, our base case calls for a stalemate between positive and negative forces. As such, our tactical asset allocation is shifting to rely less on capital gains and more on income-producing investment strategies.

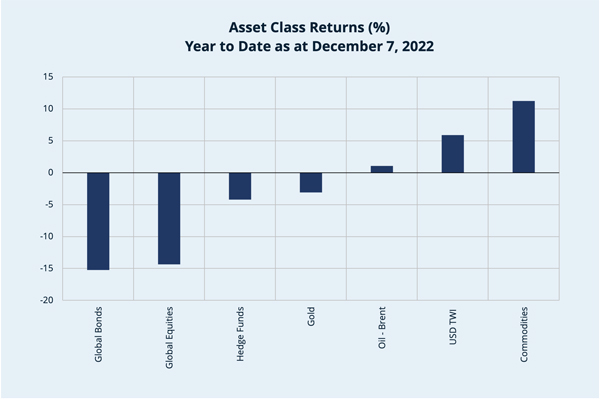

Year to date, asset class performance has been problematic. Both stocks and bonds have delivered poor results at the top-line level. However, commodities helped cushion some of the hit to portfolio performance.

Reflecting on our 2022 outlook, The Great Transformation, investing for 2022 and beyond, we stated the long-term drivers of markets would be the ‘four Ds’: Divisions, Divergence, Disruption, and Debt. Looking forward to 2023, these main drivers have reached a stage where there is a near-temporary equilibrium between push and pull factors. A temporary stalemate is likely in markets as the trajectory of change and impact from key market drivers becomes less intensive ahead of a very heavy political calendar in 2024, and statecraft becomes a major driver. Whether this is in Asia, the EU, or the Americas, allocation sectors receiving direct or indirect state support are likely to be winning satellite strategies for 2023.

While the long-term forces driving markets become temporarily less intensive, investors need to concentrate on the business cycle and monetary policy. However, here as well, we find the main drivers, growth and inflation, will also experience a type of stalemate.

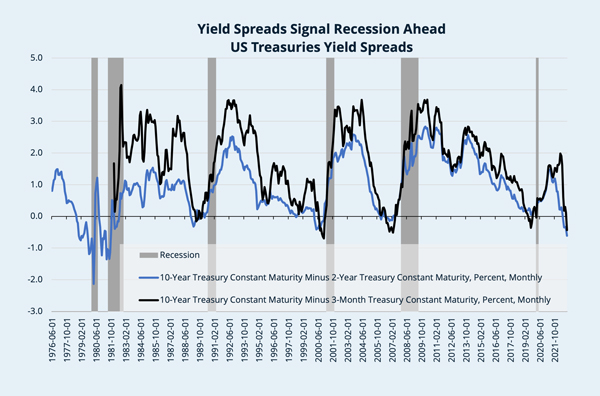

Most investors expect a recession is on the horizon; the US yield curve is shouting it with the 3-month vs. 10-year yield spread at historic low levels, see chart. Therefore, the debate is on the type and shape of the looming recession. Will it be short and shallow, long and shallow, or long and deep? Moreover, there is n growing debate on whether the central bank-engineered demand recession will trigger a balance sheet recession.

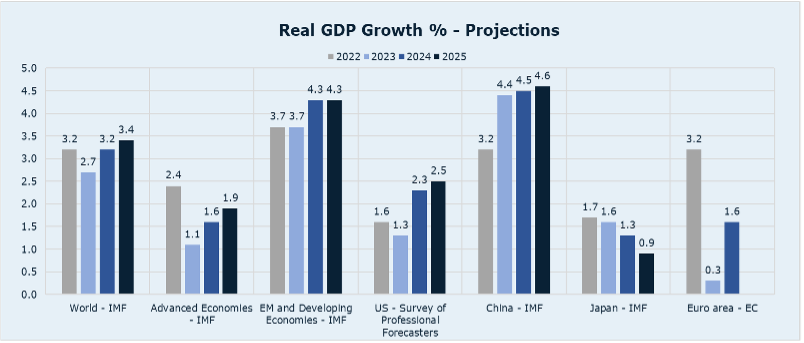

Our base case scenario calls for growth to slow, yet inflation measures to move only marginally lower. Indeed, major developed market economies are expected to decelerate in 2023, while the emerging and developing economies, as a bloc, are expected to be stable and then accelerate in 2024. The real GDP chart compares IMF forecasts of select economies as well as the European Commission (EC) and the US real GDP growth projections median data from the Survey of Professional Forecasters. Moreover, the longer-term outlook for major economies such as the US, China, or the Euro Area is challenging.

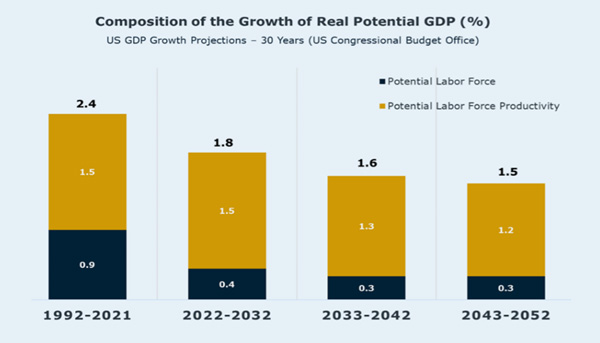

These economies are not expected to contribute to global GDP as they have done in the past. Taking the US as an example, the US Congressional Budget Office’s long-term real GDP Growth projections are extraordinarily insightful and require thoughtful consideration. Meanwhile, we expect inflation to remain problematic indefinitely due to continued demand and supply side pressures and an undercurrent of secular factors (see image) which we covered in our August 2022 insight, Secular inflation is the new normal — get ready.

Positive and negative forces will work to create a relatively well-balanced, near equilibrium; this is likely to trigger a period of stalemate in markets, especially in markets of economies where growth is expected to slow in 2023. As such, we expect limited downside risk and are comfortable tactically reducing our cash overweight and equity underweight. For now, we keep with our defe nsive sectors and quality and value-style bias for equities. For now, we keep with our year-old strategy of holding an overweight allocation to defensive sectors, quality, and value-style bias for equities; as highlighted in our October 2021, Quality will prevail. While in fixed income, our only overweight is to China government bonds. Moreover, in such an investment environment, opportunities for capital gains will be challenging to find. Therefore, the allocation strategy must be directed towards income-producing assets across fixed income, equities, commodities, and currencies.

Asset allocation

In fixed income, select emerging market debt of countries ahead in the inflation fight, with fiscal space and strong commodity sectors that stand out and are attractive. In addition, our call of ‘peak dollar’ in September 2021, that the USD strength has peaked and will fade, supports allocation to select EM local currency debt. For select EM local currency debt, the combination of yield, carry, and potential currency appreciation are all attractive features for adding onto this fixed-income sub-asset class in the months ahead. On developed market core bonds, we expect the front end to move further higher and the long end to recalibrate to higher levels; thus, we remain underweight for now. On credit, we remain cautious. The combination of slowing economies, elevated inflation, and high policy rates should create a challenging environment for many corporates. Default rates should rise as more corporate face margin compression and higher refinancing costs, especially in sectors most exposed to interest rates and input price pressures.

View our Asset Class table

Discover our latest thinking on asset classes – equities, fixed income, alternatives, commodities, and currencies. Updated every month.

In equities, defensive sectors, quality, value, and dividend payers remain the appropriate strategy across all regions. In addition, we prefer holding overweight exposure to select net commodity-exporting markets as we expect commodities, especially agricultural ones, to remain well supported indefinitely. The combination of geopolitical fragmentation increases per capita income across many emerging and developing economies. Climate event risk should be price supportive for commodity-linked assets in the long term.

Our hedge fund strategy preference remains the same. We favor Systematic/CTA, Equity Market Neutral, and Global Macro. These strategies should be best placed to provide the needed diversification and alpha in a challenging year with a market stalemate.

In commodities, as with currencies, the carry trade takes long positions in commodities where the roll yield is positive and short positions where the roll yield is negative. In commodities, a long position in commodities that are in backwardation or a short position in commodities in contango. In currencies, a long position in high-interest-rate currencies and a short position in low-interest-rate currencies. Our USD view remains unchanged. In September, we called for a “peak dollar,” that USD strength should begin to fade vs. both developed and emerging market currencies. As for gold, we remain overweight due to risk concerns and our USD view.

Important notice

The information provided herein constitutes marketing material, that may contain general information, and has been prepared by personnel in GMG Asset Management SA (collectively “GMG”) and is not based on a consideration of the prospect’s circumstances. This document reflects the sole opinion of GMG or any entity of the GMG Group and it may contains generic recommendation.

Non-Reliance: This document does not constitute a recommendation or consider the particular investment objectives, financial conditions, or needs of individual clients. Before acting on this material, you should consider whether it is suitable for your circumstances and, if necessary, seek professional advice. GMG is not soliciting any specific action based on this material it is solely intended for illustration purpose.

This document is not the result of a financial analysis and therefore is not subject to the “Directive on the Independence of Financial Research” of the Swiss Bankers Association.

This document is neither a prospectus as per article 652a or 1156 of the Swiss Code of Obligations, a listing prospectus according to the listing rules of the SIX Swiss Exchange or any other exchange or regulated trading facility in Switzerland, nor a simplified prospectus, key investor information document or prospectus as defined in the Swiss Federal Collective Investment Schemes Act. Any benchmarks/indices cited in this document are provided for information purposes only.

The accuracy, completeness or relevance of the information which has been drawn from external sources is not guaranteed although it is drawn from sources reasonably believed to be reliable. Subject to any applicable law, GMG shall not assume any liability in this respect.

Risk Disclosure: This document is of summary nature. The products referred to herein involve numerous risks (including, without limitations, credit risk, market risk, liquidity risk and currency risk). In respect of securities trading, please refer for more information on such risks to the risk disclosure brochure “Risks Involved in Trading Financial Instruments – November 2019”, which is available for free on the following website of the Swiss Bankers’ Association: www.swissbanking.org/en/home.

Material May Be Outdated: This material is produced as of a particular date. Accordingly, this material may have already been updated, modified, amended and/or supplemented by the time you receive or access it. GMG is under no obligation to notify you of such changes and you should discuss this material with your GMG relationship manager to ensure such material has not been updated, modified amended and/or supplemented. The market information displayed in this document is based on data at a given moment and may change from time to time. In addition, the views reflected herein may change without notice. No updates to this document are planned. In the event that the reader is unsure as to whether the facts in this document are up to date at the time of their proposed investment, then they should seek independent advice or contact their relationship manager at GMG.

Information Not for Further Dissemination: This document is confidential and should not be reproduced, published, or redistributed without the prior written consent of GMG.