Reflation Convictions

25 August 2021

Market Insight by Belal Mohammed Khan

|

Investor focus has so heavily fallen on the recent developments in China and key Asian markets that risks and opportunities in key developed markets appear to be somewhat overlooked.

This extraordinary and very disappointing market activity in emerging Asia markets has mired many portfolio managers. While many have been trying to understand and decide what, if any, portfolio adjustments to make, some of the recent data and data trends for key developed market economies seem to have gone under the radar.

In the US, recent economic data suggest a continued build-up of price pressures. We see inflation and inflation risks as one of the main areas of focus in markets. While the consensus opinion calls for inflationary pressures (being temporary and transitory) to fade in the months ahead, we expect that inflation is here to stay.

With regards to US inflation, the “game changing” moment occurred last August (2020) when the US central bank (Fed) revealed its new monetary policy framework of average inflation targeting (AIT). This framework shift taken in conjunction with the plethora of sizeable fiscal initiatives, the likes of which have not been seen in modern history, will result in sustained upward pressure on prices. Granular economic data, such as the National Federation of Independent Business (NFIB) association economic reports, are vital in gaining insights into the health and outlook of the US economy and to understand the bottom-up price pressures.

“Small businesses account for 44 percent of U.S. GDP, create two-thirds of net new jobs, and employ nearly half of America’s workers.” (White House, 2021) Additionally, since taking office, the Biden Administration has put the health and welfare of small US businesses front and center in the Build Back Better and other fiscal initiatives. Staying abreast of data and developments on the US small businesses provides valuable insights.

NFIB reports, such as the Small Business Jobs Openings Hard to Fill Index, which has hit all-time highs, shows unprecedented labor price pressures. Additionally, the NFIB Small Business Higher Prices Index has climbed to levels not seen since the early 1980s.

1. NFIB Small Business Job Openings Hard to Fill Index

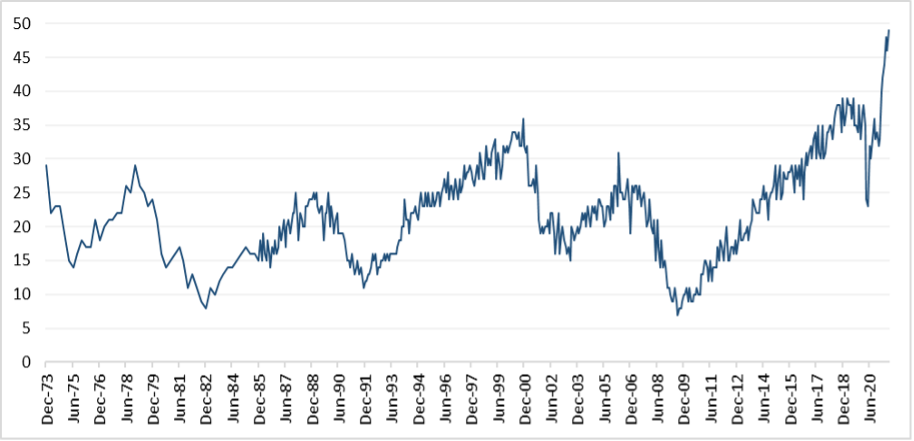

2. NFIB Small Business Higher Prices Index

Our assessment of the US growth and inflation outlook suggests the market has not fully priced in inflation price risks. Perhaps this is due to the US Fed’s insistence that price pressures are transitory and will fade. However, we expect the Fed to begin to change its view on inflation.

In our view, there is a high chance that the Fed Chair Jerome Powell will begin to more clearly articulate upside inflation risks. In such an event, the markets seem ill prepared.

If Fed communication over the next several days and weeks, leading up to the September 22-23 monetary policy meeting does develop as we expect, the US yield curve may once again quickly bear steepen (Treasury bond yields in the long-dated maturities rise faster than the short-dated maturities). A fast bear steepening may push risk-on assets to much weaker levels.

Sharp falls in risk-on markets should be viewed as an opportunity to enter and add risk given that we expect continued key developed markets to continue to grow at a healthy rate. Additionally, even if the treasuries yield curve bear steepens, we do not expect real rates to move into positive territory. If real rates are negative, policy support remains largely in place, and there is growth, investors will continue to seek out and allocate to a diversified basket of assets in their attempt to generate a positive real yield.

Our GMG portfolio positioning remains centered on our reflation convictions in key developed market economies for many reasons, especially large, historic fiscal policy initiatives.

3. Charts below of Discretionary Fiscal Response to the COVID-19 Crisis. Advanced Economies, top chart, Emerging Economies, bottom chart

Important notice

The information provided herein constitutes marketing material, that may contain general information, and has been prepared by personnel in the GMG Investment Solutions SA or GMG Institutional Asset Management SA (collectively “GMG”) and is not based on a consideration of the prospect’s circumstances. This document reflects the sole opinion of GMG or any entity of the GMG Group and it may contains generic recommendation.

Non-Reliance: This document does not constitute a recommendation or consider the particular investment objectives, financial conditions, or needs of individual clients. Before acting on this material, you should consider whether it is suitable for your circumstances and, if necessary, seek professional advice. GMG is not soliciting any specific action based on this material it is solely intended for illustration purpose.

This document is not the result of a financial analysis and therefore is not subject to the “Directive on the Independence of Financial Research” of the Swiss Bankers Association.

This document is neither a prospectus as per article 652a or 1156 of the Swiss Code of Obligations, a listing prospectus according to the listing rules of the SIX Swiss Exchange or any other exchange or regulated trading facility in Switzerland, nor a simplified prospectus, key investor information document or prospectus as defined in the Swiss Federal Collective Investment Schemes Act. Any benchmarks/indices cited in this document are provided for information purposes only.

The accuracy, completeness or relevance of the information which has been drawn from external sources is not guaranteed although it is drawn from sources reasonably believed to be reliable. Subject to any applicable law, GMG shall not assume any liability in this respect.

Risk Disclosure: This document is of summary nature. The products referred to herein involve numerous risks (including, without limitations, credit risk, market risk, liquidity risk and currency risk). In respect of securities trading, please refer for more information on such risks to the risk disclosure brochure “Risks Involved in Trading Financial Instruments – November 2019”, which is available for free on the following website of the Swiss Bankers’ Association: www.swissbanking.org/en/home.

Material May Be Outdated: This material is produced as of a particular date. Accordingly, this material may have already been updated, modified, amended and/or supplemented by the time you receive or access it. GMG is under no obligation to notify you of such changes and you should discuss this material with your GMG relationship manager to ensure such material has not been updated, modified amended and/or supplemented. The market information displayed in this document is based on data at a given moment and may change from time to time. In addition, the views reflected herein may change without notice. No updates to this document are planned. In the event that the reader is unsure as to whether the facts in this document are up to date at the time of their proposed investment, then they should seek independent advice or contact their relationship manager at GMG.

Information Not for Further Dissemination: This document is confidential and should not be reproduced, published, or redistributed without the prior written consent of GMG.