Is the Fed blinded by data?

Once dubbed ‘transitory’, the Fed’s aggressive action on inflation lacks consideration for supply-side issues.

17 March 2022

Market Insight by Belal Mohammed Khan

Reading time: 4 minutes

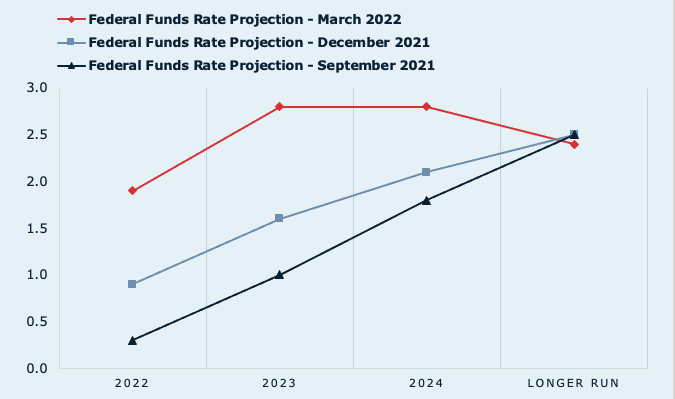

On March 16, 2022, the US Federal Reserve Bank’s Federal Open Market Committee hiked its policy rate by 25bp to 0.50%, the first policy rate action since the 1.00% cut from 1.25% to 0.25% on March 16, 2020. In Addition, the Fed’s economic projections suggest seven rate hikes in 2022 and five in 2023 (chart 1).

Chart 1. Fed’s Projected appropriate policy rate path compared with prior projections

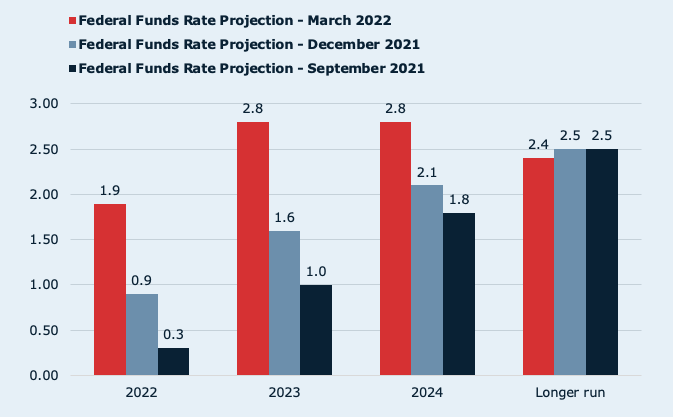

Chart 2. Detailed view of Fed’s policy rate projections compared with prior projections

Chart 3. Net Change in the Fed’s Projected appropriate policy rate path March vs. December projections

Earlier this month, President Biden mentioned inflation six times in his State of the Union addressed on March 1, 2022. With all the world’s problems and the US in particular, Mr. Biden said, “Inflation is robbing them (American families) of the gains they might otherwise feel. I get it. That’s why my top priority is getting prices under control.” Furthermore, he further said, “So what are we waiting for? Let’s get this done. And while you’re at it, confirm my nominees to the Federal Reserve, which plays a critical role in fighting inflation.”1

In the Fed’s FOMC statement released March 16, 2022, inflation is also mentioned six times — interesting fact, coincidence?

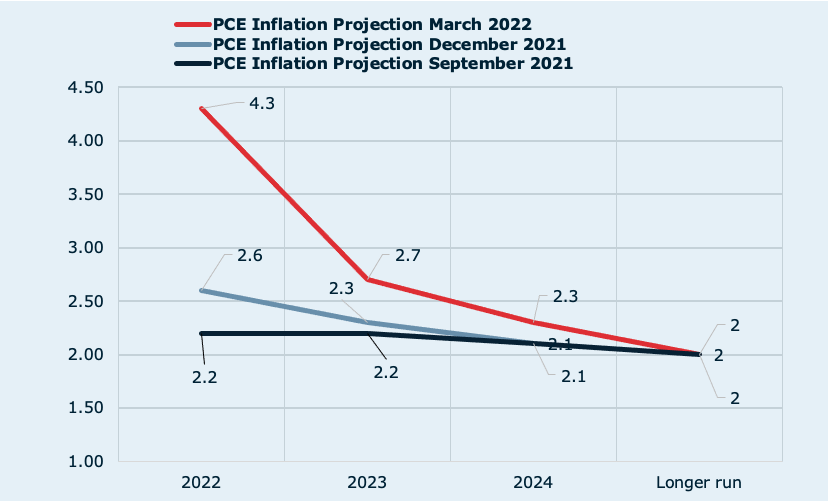

Even more interesting is that the Fed’s statement states, “Inflation remains elevated, reflecting supply and demand imbalances related to the pandemic, higher energy prices, and broader price pressures.” We agree, and we never subscribed to the idea that inflation is transitory. We believed while some factors contributing to higher inflation were transitory, most were not. While the Fed is correct that inflation stems from supply and demand imbalances, it is vital to determine the more significant variable, supply or demand? In our view, much of the price pressures are due to supply-side issues, which will take time to correct, and thus the solution to such strong price pressures is a mix of policies tools, including trade, fiscal and monetary.

Additionally, on January 28, 2022, the Federal Reserve Bank of New York’s Liberty Street Economics team released a paper, The Global Supply Side Inflationary Pressures2, which confirmed our thesis; “Our main finding is that global supply factors are very strongly associated with recent producer price index (PPI) inflation across countries, as well as with consumer price index (CPI) goods inflation, both historically and during the recent bout of inflation acceleration.”4 Therefore, we were of the view that the Fed will adjust policy slowly, more than what it signaled yesterday.

On labor market conditions, during his press conference, Powell described the labor market as being “extremely tight.” While some of the job creation seen over the past couple of quarters is likely due to the reopening of the economy, job creation has also jumped due to policies stemming from the economic security is national security initiatives introduced by the Trump administration in 2018”3, America is safer when important technology and essential products are produced domestically.”

The reopening of the economy, fiscal policy in general and fiscal policies linked to economic security coupled and in addition to the recent acceleration in reshoring due to geopolitical issues, supply chain concerns, rising offshore wages, immigration laws, concerns about product quality, among other factors has helped to ignite the job market. Bringing jobs “back home” and reinvesting, rebuilding, was it not what Trump and the Biden team wanted, to build back areas of the economy deemed to be of strategic importance? Will the Fed’s projected seven rate hikes derail Washington D.C.’s plan?

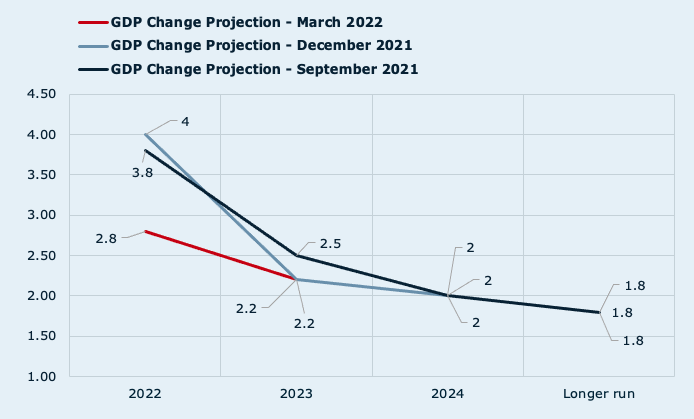

We believe the projected policy path released yesterday is too aggressive, especially considering the GDP change projections show GDP generally anchored at 2%. Was is not inflation that is supposed to be anchored somewhat around 2% in the medium term within the AIT framework?

Our key takeaway from yesterday’s Fed decision, statement4, projections, and press conference is that a complex adaptive system such as the US economy requires a more holistic analysis. Such a data-centric Fed seems to continue not to see the economy through the forest of data.

Chart 4, 5 – Fed’s GDP and PCE Inflation projections

Links

1. State of the Union Address as Prepared for Delivery, March 01 2022. (Regarding Mr. Biden’s mention, “And while you’re at it, confirm my nominees to the Federal Reserve, which plays a critical role in fighting inflation,” he is refereeing to the fact that there are three out of the seven federal reserve board seats vacant. It is also important to remember that Fed Chair Powell has been an interim chair since his renomination to a second term by Mr. Biden on November 21, 2022, is awaiting Senate confirmation. On February 4, 2022, the Federal Reserve Board named Jerome H. Powell as Chair Pro Tempore, pending Senate confirmation to a second term as Chair of the Board of Governors.)

2. About Jerome H. Powell, Chair of the Board of Governors of the Federal Reserve System.

4. The Global Supply Side of Inflationary Pressures, Liberty Street Economics

3. Federal Reserve issues FOMC statement (March 16th 2022)

Important notice

The information provided herein constitutes marketing material, that may contain general information, and has been prepared by personnel in the GMG Investment Solutions SA or GMG Institutional Asset Management SA (collectively “GMG”) and is not based on a consideration of the prospect’s circumstances. This document reflects the sole opinion of GMG or any entity of the GMG Group and it may contains generic recommendation.

Non-Reliance: This document does not constitute a recommendation or consider the particular investment objectives, financial conditions, or needs of individual clients. Before acting on this material, you should consider whether it is suitable for your circumstances and, if necessary, seek professional advice. GMG is not soliciting any specific action based on this material it is solely intended for illustration purpose.

This document is not the result of a financial analysis and therefore is not subject to the “Directive on the Independence of Financial Research” of the Swiss Bankers Association.

This document is neither a prospectus as per article 652a or 1156 of the Swiss Code of Obligations, a listing prospectus according to the listing rules of the SIX Swiss Exchange or any other exchange or regulated trading facility in Switzerland, nor a simplified prospectus, key investor information document or prospectus as defined in the Swiss Federal Collective Investment Schemes Act. Any benchmarks/indices cited in this document are provided for information purposes only.

The accuracy, completeness or relevance of the information which has been drawn from external sources is not guaranteed although it is drawn from sources reasonably believed to be reliable. Subject to any applicable law, GMG shall not assume any liability in this respect.

Risk Disclosure: This document is of summary nature. The products referred to herein involve numerous risks (including, without limitations, credit risk, market risk, liquidity risk and currency risk). In respect of securities trading, please refer for more information on such risks to the risk disclosure brochure “Risks Involved in Trading Financial Instruments – November 2019”, which is available for free on the following website of the Swiss Bankers’ Association: www.swissbanking.org/en/home.

Material May Be Outdated: This material is produced as of a particular date. Accordingly, this material may have already been updated, modified, amended and/or supplemented by the time you receive or access it. GMG is under no obligation to notify you of such changes and you should discuss this material with your GMG relationship manager to ensure such material has not been updated, modified amended and/or supplemented. The market information displayed in this document is based on data at a given moment and may change from time to time. In addition, the views reflected herein may change without notice. No updates to this document are planned. In the event that the reader is unsure as to whether the facts in this document are up to date at the time of their proposed investment, then they should seek independent advice or contact their relationship manager at GMG.

Information Not for Further Dissemination: This document is confidential and should not be reproduced, published, or redistributed without the prior written consent of GMG.