Publications

News & Media

MEDIA RELEASES

MEDIA RELEASES

GMG and Quaestor Coach Partner to Expand and Consolidate Swiss Wealth Management Market

GMG Asset Management SA is excited to announce its partnership with Quaestor Coach AG, a Swiss-based independent private equity boutique specializing in a ‘buy and build’ strategy in wealth and asset management firms.

PUBLICATIONS

PUBLICATIONS

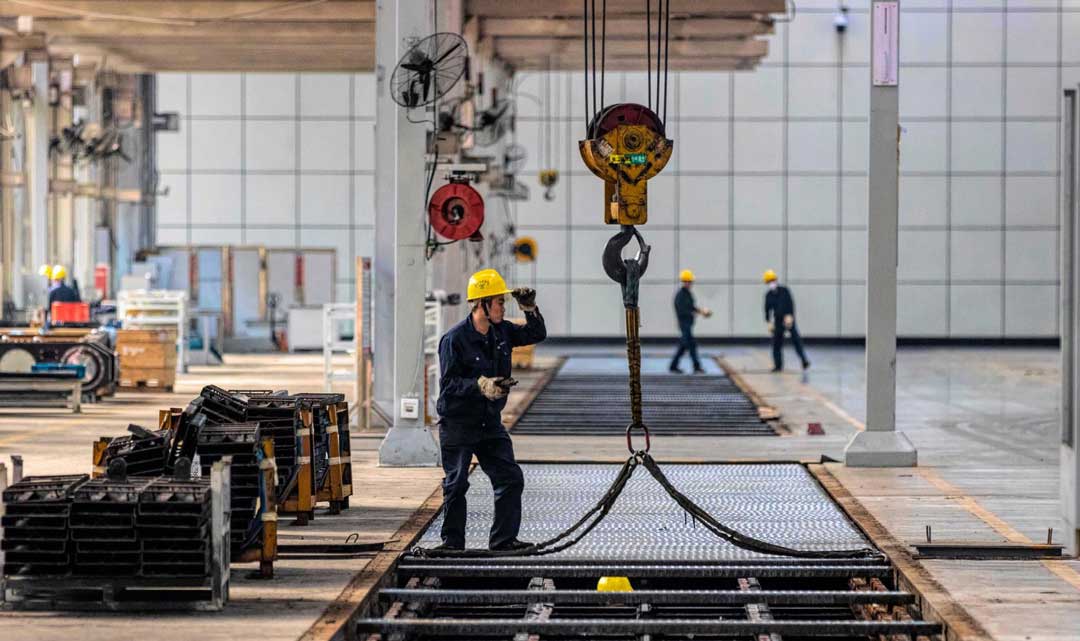

Une vague de sociétés chinoises arrive à Zurich

Ce qui a d’abord été un simple parachutage au coeur de l’été promet de laisser la place à un débarquement en ordre serré d’entreprises chinoises sur la Bourse suisse…